Why Real Estate Investment Proposals Are Your Gateway to Funding Success

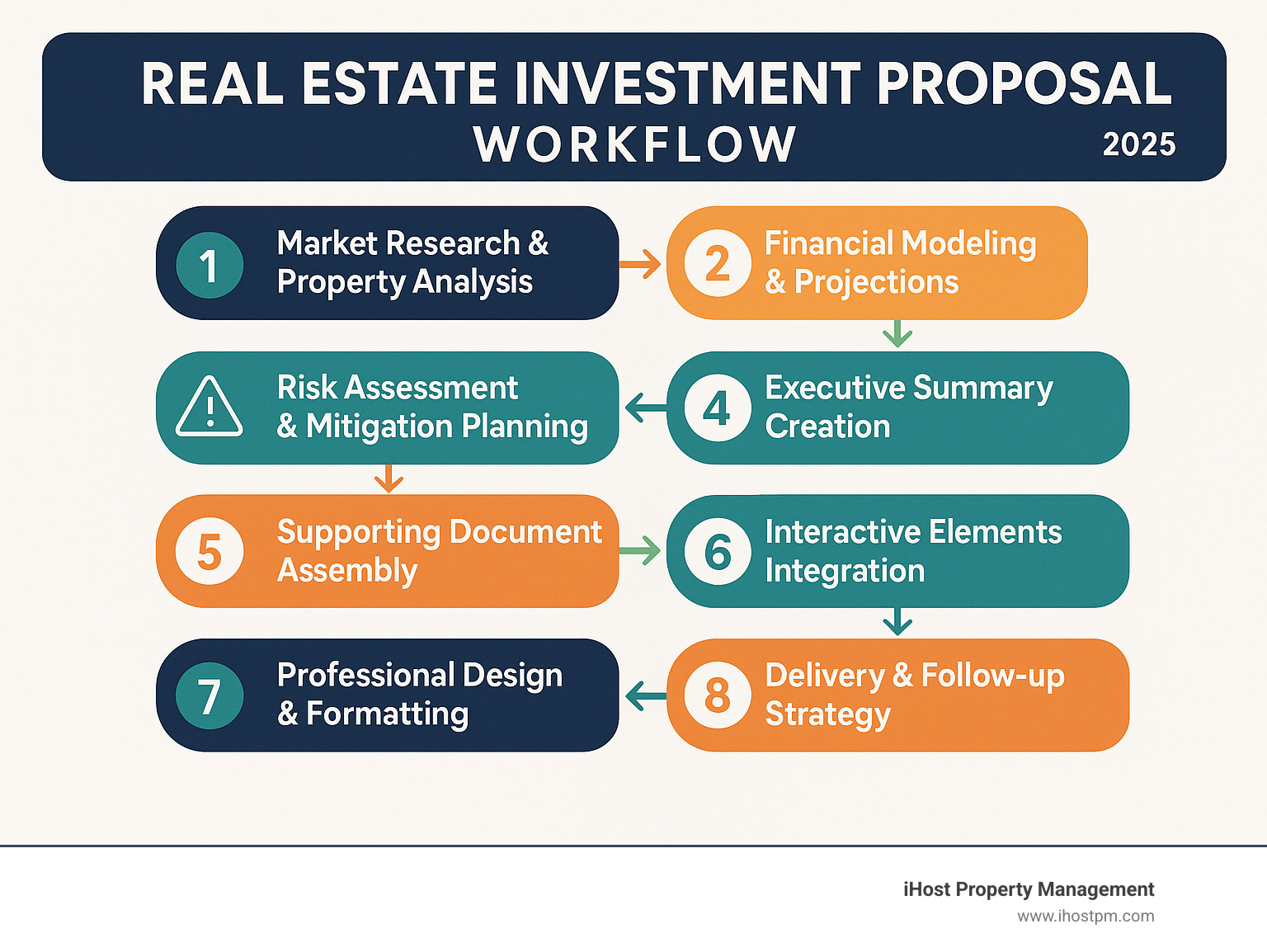

A real estate investment proposal is a comprehensive document that outlines a property investment opportunity to potential investors, detailing financial projections, market analysis, risk assessment, and expected returns. Here’s what every successful proposal must include:

Essential Components:

- Executive Summary – One-page overview with key metrics and investment highlights

- Property Details – Location, specifications, current condition, and renovation plans

- Financial Projections – NOI forecasts, IRR calculations, cash-on-cash returns, and exit strategy

- Market Analysis – Comparable sales, demographic trends, and local market conditions

- Risk Assessment – Identified risks and mitigation strategies

- Supporting Documents – Appraisals, environmental reports, and legal disclosures

The post-pandemic real estate landscape has made investor sign-off significantly more challenging. Research shows that professionally designed proposals reduce creation time by up to 50%, while those including interactive elements see 32% higher engagement rates compared to static PDFs. Most importantly, proposals with clear financial projections and risk mitigation strategies are 27% more likely to secure investor approval.

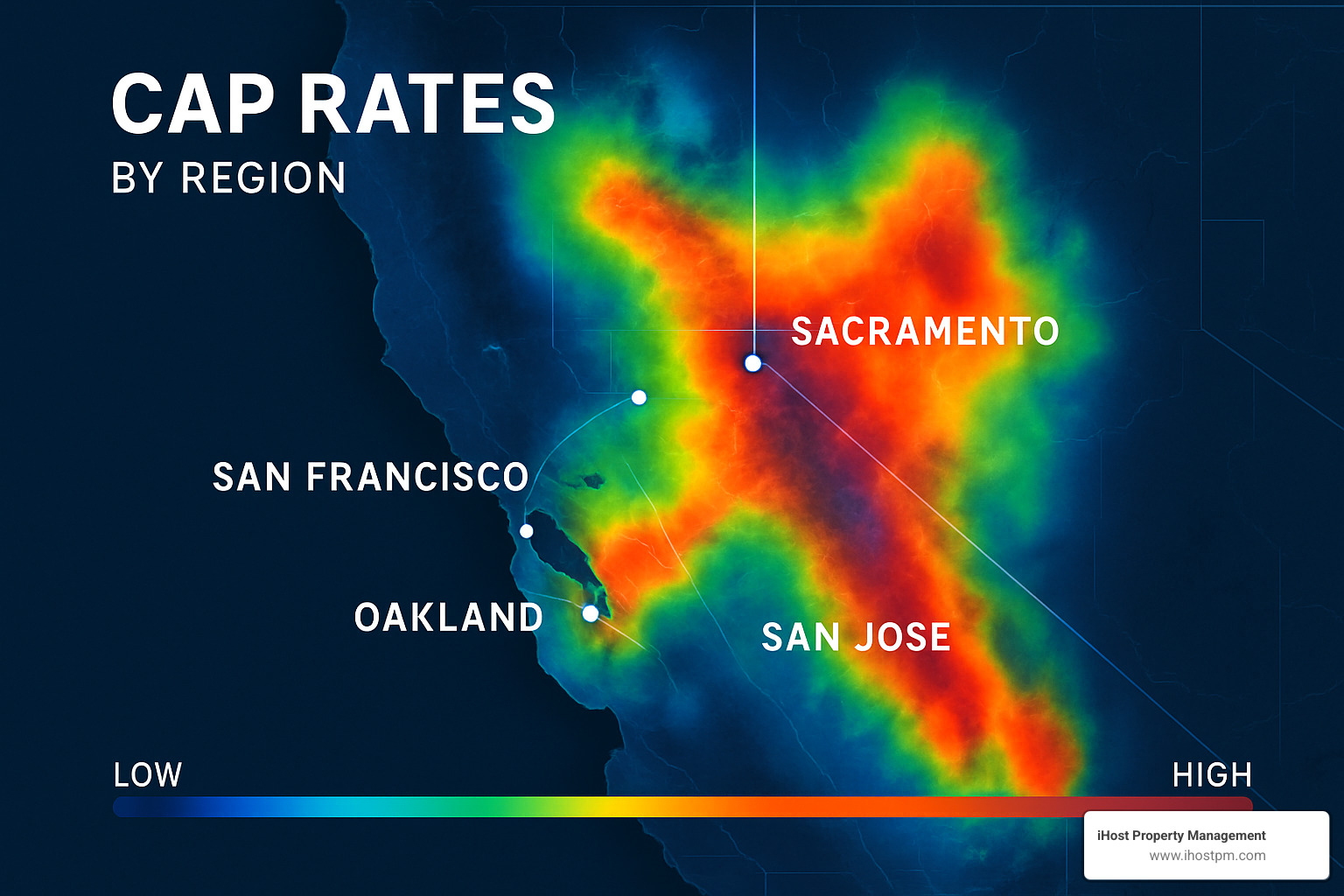

In Northern California’s competitive market, where tech-driven growth continues to fuel property appreciation, a compelling investment proposal isn’t just helpful – it’s essential for attracting the capital needed to capitalize on opportunities.

I’m Gary Gilkison, founder and CEO of iHost Property Management, and I’ve helped countless investors structure winning real estate investment proposals that secure funding for mid-term rental properties across Northern California. My experience in corporate housing and data-driven property automation has shown me exactly what investors want to see before they commit capital.

Real estate investment proposal vocab to learn:

Why a Real Estate Investment Proposal Matters

Picture this: you find an undervalued duplex in Northern California’s booming tech corridor, but you need outside capital to close fast. A real estate investment proposal turns that opportunity into a structured, data-backed story that inspires confidence—and a wire transfer.

Beyond raising cash, your proposal proves you’ve run the numbers, stress-tested the risks, and mapped the exit. Investors aren’t just vetting the property; they’re vetting you. A concise, professional deck says “trustworthy operator” far louder than any elevator pitch.

Proposal vs. Business Plan (and Everything Else)

- Business plan – long-range roadmap for an entire company.

- Development proposal – architect drawings, permit timelines, construction draws.

- Loan package – lender-focused DSCR, collateral, repayment sources.

- Investment proposal – single-deal focus: acquisition terms, projected returns, and exit.

Northern California Edge (In 3 Quick Points)

- Tech growth = demand. High-income relocations keep occupancy strong for furnished rentals.

- Resilient appreciation. Well-located assets in markets like Big Bear Lake, San Diego, and the Bay Area historically outpace national averages.

- Professional management premium. Properties run by data-driven operators (like iHost) command higher ADRs and cap rates.

Crafting a Winning Real Estate Investment Proposal

Most investors delete look-alike decks before page two. To survive the cut, open with a branded cover, striking property photo, and a one-sentence deal teaser.

Executive Summary Essentials

- Hook in 30 words.

- Key metrics (IRR, cash-on-cash, equity multiple) in bold.

- Clear exit timeline.

- One-line sponsor résumé proving you can execute.

Static PDFs vs. Interactive Decks

| Feature | Static PDF | Interactive Deck |

|---|---|---|

| Layout | Fixed | Responsive & mobile-ready |

| Analytics | None | Tracks opens & time-on-page |

| Investor tools | N/A | Built-in ROI calculator |

Interactive proposals consistently show 32 % higher engagement—and more follow-up calls.

Financials That Hold Up

Forecast NOI with conservative rent and vacancy assumptions, then present base, upside, and downside IRR cases. Sensitivity tables beat rosy single-line projections every time. For deeper modeling ideas, see our guide on real estate investment analysis.

Risk & Mitigation (Keep It Tight)

- Market shift → maintain cash reserves, diversify channels.

- Tenant seasonality → corporate, mid-term, and leisure mix.

- Cap-ex overruns → fixed-price contractor bids plus 10 % contingency.

Presenting Market Analysis & Projections that Wow

Your market section proves the upside is real. Start macro, end micro, and keep fluff to a minimum.

- Comparable sales: last 6 months, same property class, adjustments explained.

- Demographics: employment growth in tech, biotech, and professional services.

- Cap-rate benchmarks: recent trades show exit at 5.5 – 6 % for similar furnished assets.

Interactive Tools Investors Love

- ROI slider: tweak occupancy ±5 % and see IRR update live.

- Embedded floor plan: shows WFH-friendly layouts.

- Map overlay: distance to airports, HQs, and amenities.

Interactive visualizations cut review time by 60 % and boost comprehension four-fold, according to the International Journal of Human-Computer Studies.

Must-Attach Exhibits (Checklist)

- Appraisal summary

- Environmental report (Phase I)

- Detailed pro forma spreadsheet

- Current rent roll & tax bills

- 3-year cap-ex log

Tailoring & Delivering Proposals to Different Investors

One deck, three angles:

- Private angels: lead with your story and quarterly updates.

- Institutional funds: emphasize process, governance, and downside protection.

- International capital: outline U.S. tax treatment and currency wiring steps.

Always include SEC-compliant disclaimers when marketing broadly.

Digital Delivery That Converts

Mobile-friendly, password-protected links let investors scan deals on flights. Real-time analytics flag “hot” prospects (multiple opens, long dwell time) so you can schedule site tours while interest is highest.

Smart Follow-Up

Personalized emails referencing specific analytics (“noticed you spent 5 minutes on the financials”) double response rates versus generic blasts. Lock in soft commits, then move to e-signature term sheets.

Common Mistakes & Pro Tips

I’ve reviewed hundreds of real estate investment proposals over the years, and I can spot the red flags from a mile away. The biggest mistake I see? Over-promising returns that sound too good to be true. When you promise 25% IRR in a 12% market, sophisticated investors immediately question your credibility or your math skills.

Here’s the thing – conservative projections that you can actually exceed build real trust. I’d rather under-promise and over-deliver than create unrealistic expectations that damage relationships. Smart investors appreciate honesty, and they’ll come back for future deals when you prove you can hit your numbers.

Ignoring exit strategy details is another deal-killer. Investors want to know exactly how they’re getting their money back, not just vague promises about “strong appreciation potential.” Include multiple exit scenarios with realistic timing, and back up your assumptions with recent comparable sales data.

Vague timelines create unnecessary anxiety about when capital calls will happen and when returns will start flowing. If you’re planning renovations, provide detailed schedules. If you’re targeting operational improvements, give specific milestones. Investors hate surprises, especially expensive ones.

I see too many proposals with missing comparable sales data or comps that don’t actually compare to the subject property. Don’t just grab three random sales from the MLS – find truly similar properties and explain any adjustments you’re making for differences in condition, location, or timing.

Outdated visuals immediately signal that you’re not paying attention to details. Using photos from last year’s listing or generic stock images suggests you might be equally careless with financial projections. Fresh, high-quality property photos and current market data show you’re serious about the opportunity.

Next steps after sending a real estate investment proposal

Once your real estate investment proposal is in investors’ hands, your real work begins. Investor Q&A sessions are your chance to shine – prepare for questions about market conditions, property management strategies, renovation costs, and exit scenarios. I always document every question and response because they help me improve future proposals.

Term-sheet negotiation requires finding the sweet spot between investor requirements and your own objectives. Be ready to discuss preferred returns, profit splits, management fees, and decision-making authority. Consider offering different investment structures to accommodate various investor preferences and capital amounts.

Due diligence schedules need to be realistic while maintaining deal momentum. Give investors clear timelines for property inspections, financial verification, and legal documentation review. Coordinate with your attorney, accountant, and property management team early to prevent bottlenecks.

The key to success after submission is staying organized and maintaining momentum. Investors appreciate sponsors who run tight processes and communicate proactively about next steps.

Frequently Asked Questions about Real Estate Investment Proposals

What information belongs in the executive summary of a real estate investment proposal?

Think of your executive summary as your real estate investment proposal’s elevator pitch – you have about 30 seconds to capture an investor’s attention before they decide whether to keep reading or move on to the next opportunity.

Start with a compelling hook that immediately addresses what investors care about most: why this specific property will generate exceptional returns. Skip the generic introductions and dive straight into what makes this opportunity special. Is it an undervalued corporate housing property in a growing tech corridor? A luxury vacation rental in an underserved Northern California market?

Your deal metrics need to jump off the page – include projected IRR, cash-on-cash returns, equity multiples, and hold period assumptions right up front. Don’t bury these numbers in paragraphs; present them clearly with context about how they compare to typical market returns.

Sponsor credibility matters enormously at this stage. Briefly highlight your relevant experience, successful track record, and any unique advantages you bring to the table. If you’re partnering with experienced operators like professional property management companies, mention how this operational expertise improves returns through optimized occupancy and premium pricing strategies.

Close your summary with crystal-clear next steps and timeline expectations. Investors appreciate knowing exactly what you need from them and when decisions need to be made. Keep the entire executive summary to one page maximum, using bullet points and clean formatting to make key information easily scannable.

How do I present market analysis so investors trust my numbers?

Building trust in your market analysis starts with using credible, recent data sources that sophisticated investors recognize and respect. We’re talking MLS systems, CoStar, local economic development agencies, and government employment statistics – not random blog posts or outdated reports.

Cite every source clearly and stick to data from the past 6-12 months whenever possible. Investors can spot old or questionable data immediately, and it destroys credibility faster than almost any other mistake.

The key is building a comprehensive story rather than relying on cherry-picked statistics. Don’t just show one positive trend and call it a day. Instead, weave together employment growth, demographic shifts, new construction permits, and absorption rates to create a complete picture of market dynamics.

Visual presentation makes complex data digestible. Use charts and graphs that make trends obvious at first glance, then explain what the data means specifically for your investment opportunity. Connect those macro trends to micro-market implications that directly impact your property’s performance.

Here’s where many proposals fail: they ignore potential red flags hoping investors won’t notice. Smart investors always find the concerning data points, so address them proactively. If there are negative trends or risks in your market analysis, acknowledge them honestly and explain your specific mitigation strategies.

What supporting documents should I always attach?

Supporting documents serve as the foundation that validates every assumption in your real estate investment proposal. Think of them as your credibility insurance – they prove you’ve done thorough due diligence rather than just making optimistic projections.

Financial verification documents are non-negotiable. Include recent appraisals or broker price opinions that support your valuation assumptions, current rent rolls showing actual income (not projected income), property tax assessments, and utility usage history. These documents allow investors to verify the key numbers driving your return projections.

Due diligence documentation demonstrates professional standards. Attach environmental reports, survey information, and title insurance commitments to show you’ve identified potential issues before they become investor problems. For properties requiring renovation work, include detailed contractor estimates, architectural plans, and current permit status updates.

Operational transparency builds ongoing trust. Provide recent operating statements, capital expenditure history over the past 3-5 years, and existing management company agreements with fee structures clearly outlined. If you’re planning to assume existing debt or secure new financing, include loan commitment letters or term sheets showing actual financing terms rather than assumptions.

Conclusion

Creating a winning real estate investment proposal is both an art and a science. When you master this skill, you open up access to the capital that can truly transform your investment portfolio. The secret sauce? It’s all about finding that sweet spot between telling a compelling story and backing it up with rock-solid financial analysis.

Here’s what I’ve learned after years in this business: credibility beats creativity every single time when you’re dealing with serious investors. Flashy presentations might catch someone’s eye, but what keeps investors coming back deal after deal is your commitment to conservative assumptions, thorough documentation, and honest communication about both the opportunities and the risks involved.

The investors who appreciate this straightforward approach typically become your long-term partners. They’re the ones who’ll fund your second deal, your fifth deal, and beyond. These relationships become the foundation of a successful real estate investment career.

Stay action-oriented throughout the entire process. Every real estate investment proposal you send should include crystal-clear next steps, realistic timelines, and multiple ways for interested investors to engage with you. Don’t just send your proposal and hope for the best – follow up professionally and persistently, using engagement data to guide your outreach strategy.

For investors eyeing Northern California opportunities, there’s a game-changing advantage you should consider: partnering with experienced property management companies. This partnership doesn’t just improve your operational success – it dramatically boosts your proposal credibility too.

At iHost Property Management, we’ve seen how our turnkey approach transforms investor presentations. When you can tell potential investors that everything from guest acquisition and experience management to revenue optimization and property maintenance is handled by professionals, it creates a compelling narrative that resonates with sophisticated investors seeking truly passive income opportunities.

Our specialization in luxury vacation rentals and corporate housing through data-driven operations, 24/7 VIP services, and cutting-edge technology platforms allows investors to focus on what they do best – sourcing deals and raising capital – while we handle the day-to-day complexities that can make or break investment returns.

This partnership model creates exactly the kind of operational sophistication that investors value highly. It shows them you’re not just another amateur trying to figure things out as you go – you’re a professional who understands that successful real estate investing requires expert execution at every level.

Whether you’re targeting individual property investments or building a diversified portfolio across multiple Northern California markets, having professional property management in place demonstrates the kind of operational excellence that separates successful proposals from the pile of rejected opportunities on every investor’s desk.

Ready to see how professional property management can strengthen your investment proposals while boosting your actual returns? Learn more about our comprehensive approach to investment property management, or find our Co-Host Plus program designed specifically for serious real estate investors like you.

The Northern California market continues to offer exceptional opportunities for investors who approach it with the right combination of market knowledge, financial sophistication, and operational excellence. Your next successful real estate investment proposal could very well be the foundation for a partnership that generates solid returns for years to come.